Increasing Cigarette Taxes Could Boost Child Survival Rates

Research conducted by the Karolinska Institutet suggests that implementing higher taxes on cigarettes in low- and middle-income countries (LMICs) could significantly reduce child mortality rates, especially among the most impoverished children. Published in The Lancet Public Health, the study titled "Cigarette taxation and socioeconomic inequalities in under-five mortality across 94 low- and middle-income countries" highlights the potential health benefits of such fiscal policies.

The World Health Organization (WHO) recommends that cigarette taxes constitute at least 75% of the retail price; however, many countries fall short of this benchmark. If all 94 countries involved in the study had adopted the WHO’s recommended level, it is estimated that over 280,000 children's lives could be saved annually. Additionally, increasing cigarette taxes could help narrow the socioeconomic disparities in child mortality rates, aligning with the United Nations' sustainable development goals.

The study examined data spanning from 2008 to 2020, sourced from WHO, the World Bank, and the UN Inter-agency Group for Child Mortality Estimation. It analyzed various taxation methods including specific excise duties (fixed amount per pack), ad valorem duties (percentage of product value), import duties, and VAT. Findings indicate that higher cigarette taxes, particularly excise duties, positively influence child survival across different economic groups, reducing mortality differentials between the wealthiest and poorest children.

Lead researcher Olivia Bannon emphasizes that in addition to health benefits, increasing tobacco taxes is a vital policy tool to combat the disproportionate burden of tobacco-related morbidity and mortality among children in LMICs. She highlights the importance of countering tobacco industry tactics aimed at undermining such public health measures.

The study underscores the need for governments to overcome industry interference and other barriers to enforce effective tobacco taxation policies. Collaborative efforts involved researchers from Erasmus MC in the Netherlands, McGill University in Canada, and Imperial College London in the UK.

In conclusion, elevating cigarette taxes is not only a cost-effective strategy to improve child health worldwide but also a means to promote greater health equity among socioeconomic groups.

Source: Medical Xpress

Stay Updated with Mia's Feed

Get the latest health & wellness insights delivered straight to your inbox.

Related Articles

Underutilization of Healthcare Interpreters Highlights Need for Better Education and Awareness

Research highlights the underuse of professional healthcare interpreters in Australia, emphasizing the need for improved awareness, training, and reliance on qualified language services to enhance patient safety and health outcomes.

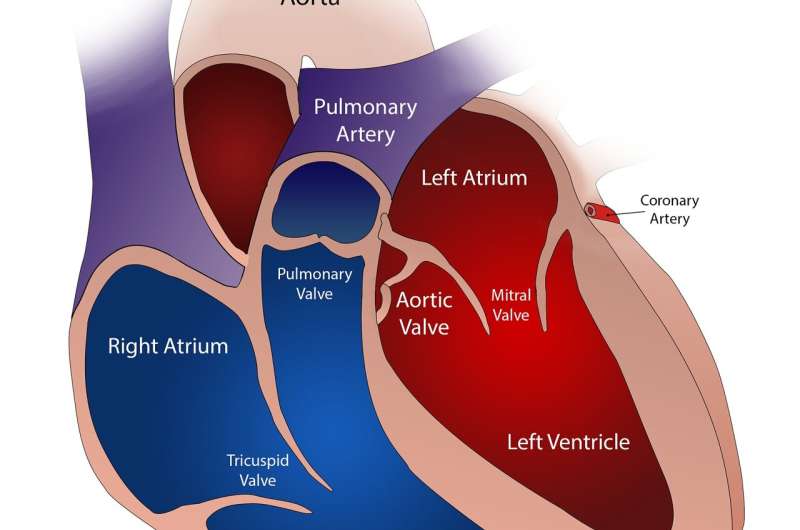

New Insights on Treating Multivessel Coronary Artery Disease: Immediate vs. Staged Revascularization

Recent research at ESC Congress 2025 reveals that staged revascularization may be safer than immediate PCI in certain patients with multivessel coronary artery disease experiencing STEMI, especially those with signs of heart failure. Personalized treatment strategies are crucial for optimal outcomes.

Understanding How Leukemia Virus Remains Hidden in the Body—Implications for Future Treatments

New research uncovers how HTLV-1, the virus linked to leukemia, remains hidden in the body through a genetic silencer. This discovery could lead to innovative therapies for retroviral infections like HIV and HTLV-1.

The Diabetes Paradox: Health Gains Not Translating into Better Workforce Participation

Despite significant health advancements, people with diabetes still face lower employment rates and higher disability claims. Recent research uncovers the persistent 'diabetes paradox' impacting workforce participation and highlights the need for comprehensive strategies to improve economic engagement.